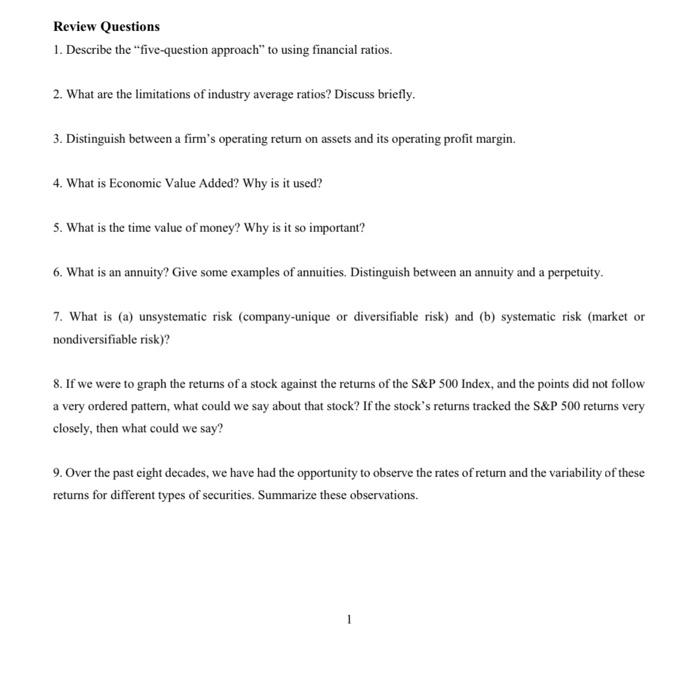

Describe the Five Question Approach to Using Financial Ratios

Liquidity or solvency ratios are described as the ability for a company. Describe the five-question approach to using financial ratios.

Financial Ratios Calculations Accountingcoach

Leverage Financial Ratios Those financial ratios that show the percentage of a companys capital structure that is made up on debt or.

. How liquid is the firm. What are the limitations of industry average ratios. The five question approach to using financial ratios is as follows.

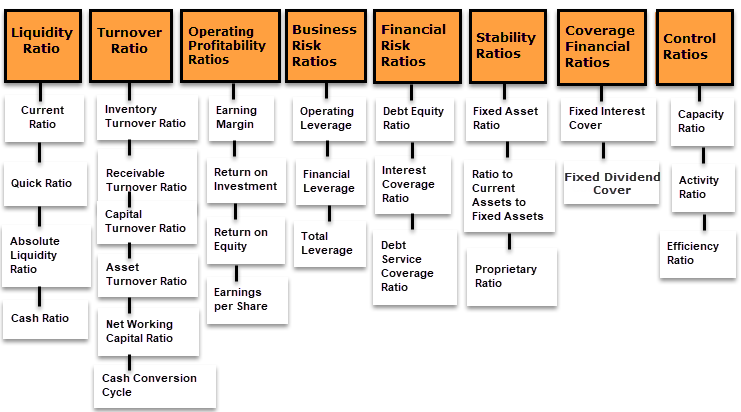

B Using the financial information provided above and the ratios you have calculated prepare a report which analyses and compares the efficiency of operations and short term financial strength of Bungoni Limited and Amana Limited QUESTION 2 CPA May 2005 The aim of companies publishing comparative figures and yearly summaries is to enable. Operating profitability ratios 4. Describe the five-question approach to using financial ratios.

Business risk operating analysis. What is Economic Value Added. Limitation of financial statements.

Internal liquidity ratios 2. The current ratio Current Ratio Formula The Current Ratio formula is Current Assets Current Liabilities. 2 Is management of the company ge View the full answer.

Some of the limitations of financial ratios are as follows. The Altmans Z-score formula is written as follows. These ratios are calculated using numbers taken from a companys balance sheet profit loss ac and cash flow statements.

How liquid is the firm. Hence I though to prepare a comprehensive guide about how to interpret financial ratios to analyse a company. The current ratio is a reflection of financial strength.

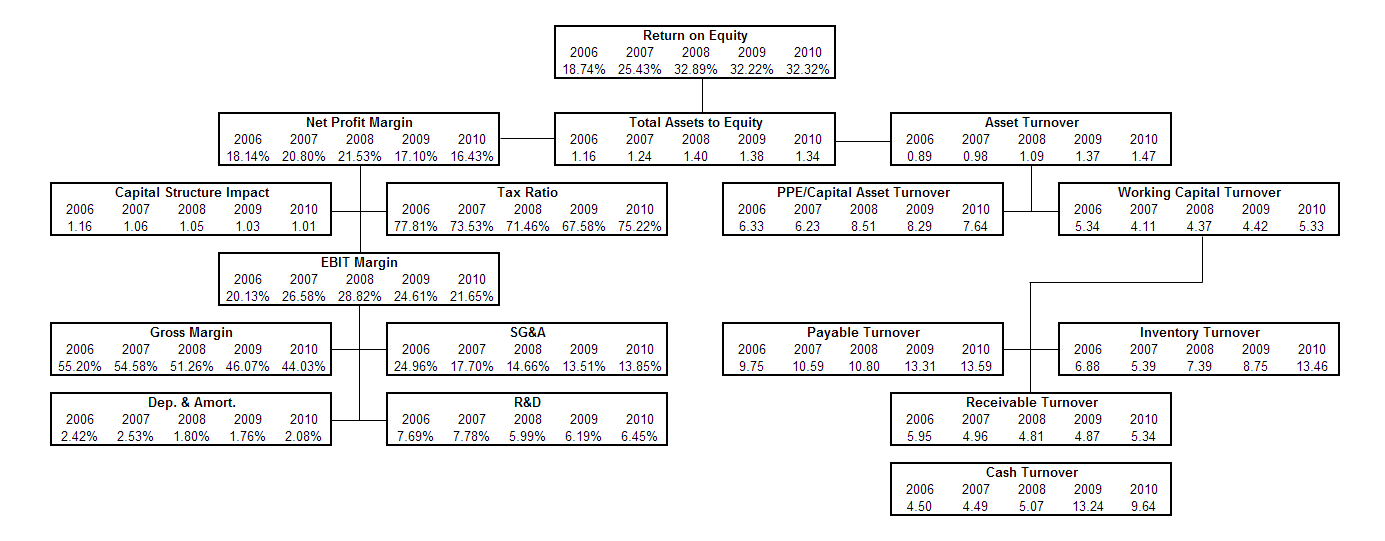

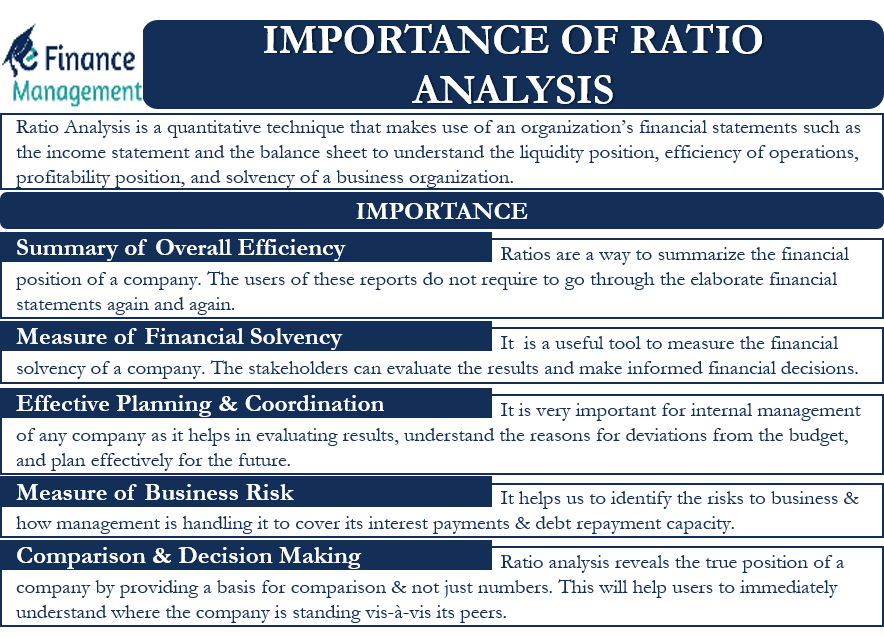

The importance and advantages of financial ratios are given below. Are the managers of the firm creating value for the shareholders. There are six categories of financial ratios that business managers normally use in their analysis.

Answer A The five question approach to financial ratios are as follows- 1 How liquid is the firm like calculating Current ratio Quick ratio Accounts receivable turnover Days in receivables Inventory turnover. A companys financial statements consist of the balance sheet income statement and statement of cash flows. Within these six categories are 15 financial ratios that help a business manager and outside investors analyze the financial health of the firm.

These questions along with the related ratios may be stated as follows. Describe the five question approach to using financial ratios. This is to determine if the company has the ability to repay creditors in a timely manner and compares the current assets to current liabilities as well as the quality of the individual current assets.

Financial ratios are only valuable if there is a basis of comparison for. It increases the models accuracy when measuring the financial health of a company and its probability of going bankrupt. Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations.

The Z-score model is based on five key financial ratios and it relies on the information contained in the 10-K report. What is the time value of money. Describe the five question approach to using financial ratios.

Is the firm liquid enough. Operating efficiency ratios 3. Financial ratio analysis helps a business in a number of ways.

Iii Ratios assist the management in decision making. The five question approach is a method of teaching about financial ratios that uses ratios to answer the following five questions. Liquidity of a business is defined as its ability to meet maturing debt obligations.

The five question approach clusters financial ratios around important questions that may be addressed to some extent by certain ratios. However they have a number of limitations which should be kept in mind while preparing or using them. ζ 12A 14B 33C 06D 10E.

Why is it used. I Ratios help in analyzing the performance trends over a long period of time. 1 Ratios are based on accounting figures given in.

Ii They also help a business to compare the financial results to those of competitors. To interpret the numbers in these three reports it is essential for the reader to use financial ratios. Here is the formula to compute the current ratio.

It is the number of times a companys current assets exceed its current liabilities which is an indication of the solvency of that business. Is the business able to make efficient use of the resources by generating good returns on the investments of owners. The five categories of financial ratios are liquidity solvency leverage debt asset efficiency turnover profitability and market ratios.

Are the firms managers generating adequate operating profits from the companys. How liquid is the firm. These ratios measure the return earned on a companys capital and the profit and expense margins on each of its sales.

The current ratio also known as the working capital ratio measures the capability of a business to. Common liquidity ratios include the following. Current ratio Acid-test Quick ratio Accounts receivable turnover average collection period Days in receivables Inventory turnover Days in.

In other words a large amount of current assets in relationship to a small amount of current liabilities provides some assurance that the obligations coming due will be paid. Limitation of ratios. How profitable is the business.

Distinguish between a firms operating return on assets and its operating profit margin. Financial statement analysis through ratios is useful because they highlight relationships between items in the financial statements. How are the assets of the business financed.

Types of Financial Ratios. The current ratio is used as an indicator of a companys liquidity. Describe what each statement tells us and.

The current ratio is a financial ratio that shows the proportion of current assets to current liabilities. KEY FINANCIAL RATIOS The thorough valuation analyst will consider and compute five categories of ratios. Leverage Financial Ratios Those financial ratios that show the percentage of a companys capital structure that is made up on debt or.

Selected Financial Ratios Ratio Formula Download Table

Financial Ratios Calculations Accountingcoach

Solved Review Questions 1 Describe The Five Question Chegg Com

How To Do Fundamental Analysis On Stocks Money Management Advice Finance Investing Budgeting Money

Limitations Of Ratio Analysis Ratios Are Popular Learn About The Problems

Importance Of Ratio Analysis Meaning Importance And Uses

Profitability Ratios Calculate Margin Profits Return On Equity Roe

Financial Ratios Quiz And Test Accountingcoach

Preparation Of Income Statement And Balance Sheet With The Help Of Financial Ratios Basic Concepts Of Financial Accounting For Cpa Exam

Selected Financial Ratios Ratio Formula Download Table

Financial Analysis Tools Top 4 Tools Used For Analysis

Financial Ratios Calculations Accountingcoach

Financial Ratios Calculations Accountingcoach

Financial Ratio Analysis Of Failed Companies Using Data Over Five Download Table

Preparation Of Income Statement And Balance Sheet With The Help Of Financial Ratios Basic Concepts Of Financial Accounting For Cpa Exam

Financial Ratios Calculations Accountingcoach

6 Basic Financial Ratios And What They Reveal

Cost Drivers Analysis Powerpoint Core Competencies Business Strategy Analysis

Comments

Post a Comment